🙅♀️ This internship is for working class only 📝 Resources for changing careers + 🧐 Why crypto's gone mainstream

Good afternoon and welcome back to The 99: the home of financial news and insights made simple. You can count on accessible, trustworthy, and unbiased news insights every Monday.

Struggling to view the whole email? Somewhere above this text you’ll see ‘view on web’.

August break 🏝️

For the last couple of years, GFY has taken a short break over August and we’ll be doing the same again this year, returning week of 1 September with our regular newsletter format (and all the stories and explainers you enjoy).

Following your feedback, we’re also considering changing the day of the week that The 99 lands in your inbox. We'd love to get your opinion:

If you have any questions or feedback, just reply to this email or leave a comment.

Alice & the GFY team x

If you have a money or career dilemma that you’d like to share, our community forum is a supportive space with over 1,800 people ready to share their experiences and perspectives.

Books/blogs/podcasts etc. on changing careers

Hello, I am searching for some help and thought I would be brave and make a post:

Does anyone have any recommendations for good resources like books/blogs/podcasts out there about rethinking careers/work, particularly after having children, that anyone could point me to please?

I am in pickle with work, feeling stuck, tempted to do the 'quiet quitting' thing but then I get overwhelmed and anxious about all the things I'm not doing 😂 I don't like my job but I'm also grateful to have a job.

Thank you in advance!

📰 The 99 Quick News

👍 A good week for… interest rates (perhaps…)

The 99 TL;DR: We’re quite certain the Bank of England will cut its base rate from 4.25% to 4% on Thursday 7 August. That’s down to softer jobs data, slowing growth, and a hit to trade from recent tariffs. Traders are already pricing in another rate cut before the end of 2025.

Why it matters:

If you have a tracker mortgage, overdraft, credit card or floating-rate business loan, your monthly interest costs could drop.

It signals the BoE is shifting focus from fighting inflation to helping the economy grow.

Read more: Reuters – Bank of England faces inflation challenge as it prepares to cut rates

👎 A bad week for… Builder.ai

The 99 TL;DR: A £1 billion‑valued UK startup suddenly collapsed and went into administration, its investors pulled support because revenue never materialised and costs spiralled.

Why it matters: It’s a reality check for tech hype where valuations can crash fast if growth doesn’t happen fast.

Read more: Bloomberg – Startup Builder.ai Goes From $1.5 Billion Unicorn to Bankruptcy

Working Class Only: The New Civil Service Internship Explained

Fast-tracked jobs, £452 a week, and only for students from lower-income backgrounds

The 99 TL;DR

Progress or social engineering? From summer 2026, the UK’s Civil Service will offer two-month paid internships (£452 per week) exclusively to students from lower socio-economic backgrounds. Eligibility is based on what job the highest earner in your household held when you were 14. Interns will receive mentoring, policy work experience, and the chance to fast track into the elite Fast Stream graduate scheme. Applications open in October 2025, with internships running July to August 2026.

What’s actually changing

The government is overhauling its Summer Internship Programme so that only applicants from working class backgrounds can apply.

You’ll be classed as working class based on what job the highest earner in your household did when you were 14. The classification system is set by the Social Mobility Commission.

This change is part of a wider Labour plan to open up access to public sector jobs and reform how government works.

Who can apply and how class is defined

The official criteria say you must:

Be in the final two years of a UK undergraduate degree

Be on track for a 2:2 or higher

Have the right to work in the UK

Be from a lower socio-economic background, defined by the job of the highest-earning adult in your household at age 14

✅ Examples of eligible jobs: cleaner, bricklayer, delivery driver, warehouse assistant

👎 Not eligible: nurse, teacher, engineer, IT manager, journalist

This classification approach is already used across other Civil Service data and reporting.

What interns actually get

A paid two-month placement in a government department (July to August 2026)

£452 per week, paid monthly

Experience may include writing ministerial briefings, shadowing senior civil servants, planning events, and doing policy research

A current Fast Streamer will act as your mentor

You'll attend central events and a formal welcome reception

Interns rated highly will receive a Fast Pass, which allows them to skip early stages of the Fast Stream selection process if they apply within 12 months

Why it matters

In 2024, only 12 percent of successful Fast Stream applicants were from lower socio-economic backgrounds, despite making up 25 percent of university students.

The government says the scheme is about making government better by making it more reflective of the country it serves.

Pat McFadden, the minister in charge of Civil Service reform, said:

“Government makes better decisions when it represents and understands the people we serve.”

What critics are saying

Unions and social mobility charities welcomed the decision, saying it tackles long-standing class exclusion in elite public sector roles.

But it has sparked backlash from senior Conservatives…

Kemi Badenoch, leader of the opposition, said:

“A Conservative government would scrap all this rubbish and hire the best people.”

Mike Wood, shadow cabinet office minister, added:

“No young person should be told they’re not welcome based solely on leftist social engineering.”

Even supporters warn that barriers persist. Dave Penman from the FDA union said:

“If you do manage to get into the Civil Service, you will not always get on.”

(FDA Union Statement)

Is this positive discrimination?

No. Under the Equality Act 2010, positive discrimination means hiring someone solely because of a protected characteristic like race or gender, regardless of merit. This is not allowed.

However, employers can take positive action to support under-represented groups with protected characteristics, as long as it helps overcome barriers or disadvantage, and the individuals are equally qualified.

In this case, socio-economic background is not a protected characteristic, so the Civil Service internship scheme does not fall under either definition and is lawful.

What do you think?

🔗 Sources

Civil Service Careers – Summer Internship Programme (Civil Service Careers)

GOV.UK (Cabinet Office) – Internship Scheme To Get More Working Class Students Into Civil Service (GOV.UK)

The Guardian – New UK civil service internship scheme open only to working‑class students (theguardian.com)

Civil Service World – Civil service internship scheme now targets only ‘working class’ applicants (civilserviceworld.com)

Crypto goes mainstream - An Explainer for UK Readers

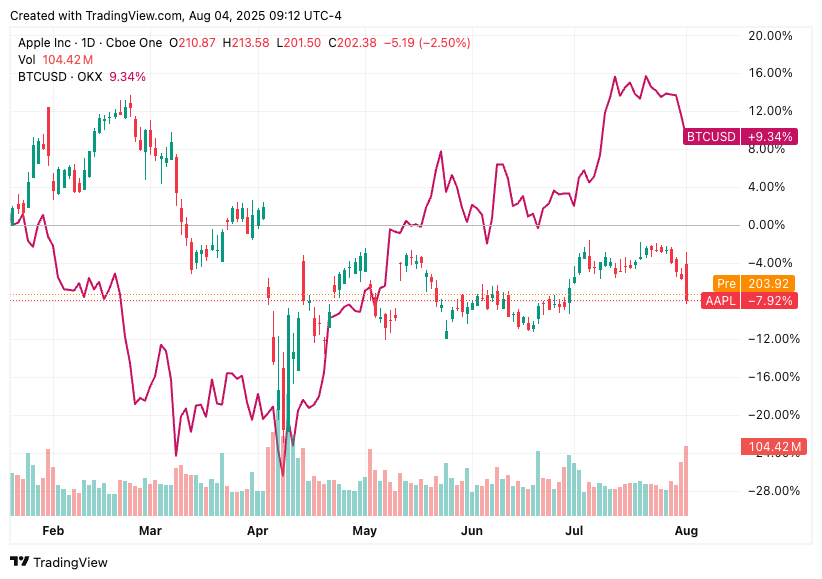

TL;DR: Everyone’s a crypto bro, even mainstream financial institutions. Bitcoin peaked at a record $123,153 in mid-July, pushing the total crypto market to around $4 trillion. Although it eased a bit last week, many UK investors are asking: is it still worth paying attention?

What happened?

In mid-July, Bitcoin climbed past $118,000 and soon hit $123,153 – its highest price ever recorded, before settling around $119,750.

Meanwhile, the global crypto market value hit approximately $3.8 trillion, largely lifted by institutional (big firms and banks) buying and positive sentiment around U.S. crypto lawmaking (dubbed, “Crypto Week”).

At the same time, Ether (Ethereum) also surged to its highest level in six months, hitting over $3,640 and helping to pump related digital asset prices, including crypto ETFs and crypto-linked equities.

Why did it rise in July?

The U.S. Congress and President signed several crypto-related bills to bring more legal clarity, including rules for stablecoins and definitions of crypto asset types.

That made big investors more confident and led to large inflows via exchange‑traded funds (ETFs), and even corporate treasury purchases.

What happened last week?

The rush to $123k slowed. Bitcoin dropped around 7%, falling into the $114,000–$116,000 range, before bouncing back slightly. Market cap has mostly held its gains near the $3.8 trillion area. There has also been increased chatter about whether the rally has gone too far too fast.

Why it matters to UK readers

Crypto tax still applies: Any gains are taxable as capital gains and must be declared via self-assessment.

UK crypto platforms remain mostly unregulated. The FCA warns that consumers have limited protection if an exchange fails or turns out to be fraudulent.

Proposed rules by the UK regulator may soon ban borrowing (like using credit cards) to buy crypto, a sign that regulators are getting stricter even as they mull how to bring crypto firms into supervision.

Regulation isn’t always a bad thing however, as it can bring frameworks and legitimacy to crypto as an investment.

What could spark a crash?

If U.S. crypto legislation stalls or faces legal challenges.

A sharp rise in U.S. interest rates or a broader sell-off in stocks could drain risk appetite.

If institutions shift strategy so quickly, Bitcoin could slide 20–30% in a short period. This wouldn’t be the first time.

What to keep an eye on next 👀

Whether the crypto laws pass smoothly and how regulators implement them in practice.

If more money keeps flowing into Bitcoin ETFs (funds that let people invest in crypto without buying it directly) and companies keep adding Bitcoin to their balance sheets, prices could keep rising.

FCA and HMRC updates on crypto regulation, borrowing rules, and consumer protection changes.

🔗 Sources

Reuters – Bitcoin climbs to record $123,000 as investors eye U.S. policy boost (Reuters)

Reuters – Crypto sector breaches $4 trillion in market value during pivotal week (Reuters)

Reuters – Crypto stocks jump as Ether scales six‑month high (Reuters)

Reuters – Crypto‑linked stocks advance after Trump signs stablecoin law (Reuters)

Financial Times – Britain to ban consumers borrowing to buy cryptocurrencies (Financial Times)

Financial Times – UK lifts ban on some crypto‑linked securities for retail investors (Financial Times)

Financial News London –Crypto market absorbs $9 billion bitcoin sale with ‘barely a blip’ (fnlondon.com)

Most drivers won’t get compensation for car loan commissions

TL;DR The UK Supreme Court has ruled that car dealerships and lenders don’t owe customers a fiduciary duty on finance deals. That shuts down lawsuits over hidden commissions for millions of loans sold between 2007 and 2021. But the FCA still plans a compensation scheme worth £9 to £18 billion for cases where dealers hiked interest rates to earn extra commission. One case under consumer law (Marcus Johnson’s) survives and he’ll get about £1,650 under unfair relationship rules.

What was this all about?

Some courts had said that if a car dealer earned secret commission from a lender and didn’t properly disclose it, that could make the whole finance agreement dodgy. The idea was that the dealer might have had a duty to act in your best interest which they obviously didn’t if they were getting paid to bump up the interest rate. If that ruling had stuck, lenders might have had to cough up billions in refunds.

What the Supreme Court said

That interpretation's been thrown out. The court said car dealers don’t usually have a fiduciary duty to the people buying the cars. So most customers can’t claim refunds just because the dealer got a secret commission. The case of Marcus Johnson still stands because he claimed his deal was “unfair” under consumer law. But that kind of case is now the exception not the rule.

What this means for banks

Lenders like Lloyds and Close Brothers had put aside nearly £2 billion just in case they lost. That risk is now smaller but not zero. The FCA still thinks some lenders owe compensation if they allowed dealers to hike interest rates just to earn more commission. The regulator’s estimate is £9 to £18 billion in potential redress depending on how many customers qualify.

What the FCA is doing

The FCA is planning a compensation scheme for people who took out car finance through dealerships between 2007 and 2021 where the dealer could adjust the interest rate and pocket the extra. The idea is to refund customers who were charged more just so the dealer could earn more. The consultation is coming in October and payouts could land in 2026.

What if you had car finance?

If you bought a car on finance through a dealership before 2021 and think your interest rate was high or unfair you might qualify for a refund. But most people probably won’t see more than £950 and only a handful will go down the legal route. If your agreement was clear and the commission was disclosed there’s not much to claim for.

So what happens next?

The FCA will launch its consultation in October

You’ll be able to check if you qualify

Most payouts will likely happen automatically once the rules are agreed

This could cost the industry billions and affect lending rules going forward

🔗 Sources

Reuters – UK Supreme Court overturns ruling on motor finance commissions in win for banks

The Standard – Lenders do not owe millions compensation over car finance, Supreme Court rules

If you aren’t already, make sure you’re subscribed so that you are first to receive the 99 in your inbox every Monday.

Thank you for reading. If you’ve enjoyed this week’s 99, please consider sharing with a friend or someone who might be interested.