🥾 Salt Path: Unpacking the financial scandal, 😀 Top 10 happiest shift jobs + 📉 The news that might tax them

Good afternoon and welcome back to The 99: the home of financial news and insights made simple. You can count on accessible, trustworthy, and unbiased news insights every Monday.

Struggling to view the whole email? Somewhere above this text you’ll see ‘view on web’.

Introducing GFY on Substack

As we mentioned last week, GFY’s emails are now being sent from and hosted on Substack - this won’t change what you receive (other than emails looking a little different) but it should improve your experience of accessing past editions and other content.

Alice & the GFY team x

☕️ Ad break in partnership with Nous

✅ Monday To-Do: Claim £50

Nous is a free tool we love that checks if you're being ripped off, finds better deals on things like your internet and energy etc and switches you over automatically. At the moment, there’s a £50 bonus when you switch via GFY. For ease, you can use Nous via WhatsApp if you like.

📧 They also have a clever tool you can choose to use that safely searches your emails to find all of your providers - no need to remember login details.

It takes minutes. No premium plan. No catches.

💷 How do I get the £50?

Sign up using this link

You do not need to pay anything or sign up to premium

Once Nous sorts your first switch, you’ll get a £50 welcome bonus, in addition to the savings they find for you.

All you need to do is switch at least one provider (Nous will make sure you get a better deal)

If you have a money or career dilemma that you’d like to share, our community forum is a supportive space with over 1,800 people ready to share their experiences and perspective. Here’s a dilemma shared last week:

Mortgage Overpayments or Invest?

Hi everyone

Just wondering if people had any advice on whether to continue with a £100 overpayment on my mortgage (currently on a BoE tracker rate @ 4.9% and £193k/31yrs remaining, paying £1k/mth, £1.1k with overpayment) or to stop that and put an extra £50 a month into my two stocks/shares investments?

I put £100/mth into each of those. One of these (at about 3k) are currently saying Simple Return +13.34%, TWRR +24.97%, the other (at 7k) is saying Total return +12.74%, Annualised return +4.16%.

I get that the returns are going to go up and down over time but I thought the general idea was put money where the higher interest is but the different rates in my investments are making my decision less clear.

Thanks in advance!!

📰 The 99 Quick News

👎 A bad week for…Monzo

The 99 TL;DR: The FCA penalised Monzo £21.1 million after discovering it onboarded over 34,000 high‑risk customers between 2018–2022, some registering bogus addresses like Buckingham Palace, 10 Downing Street and even Monzo’s own HQ. Monzo says it has overhauled its controls and resolved the issues.

Why it matters: This highlights growing regulatory scrutiny on digital banks and their anti‑money laundering systems. As fintechs scale fast, compliance can’t be an afterthought, customers and the industry demand stronger crime prevention.

Read more: Monzo fined £28mn after customers used No 10 and Buckingham Palace as addresses (Reuters)

👍 A good week for…M&S, the NCA and UK Cybersecurity

The 99 TL;DR: UK police in a National Crime Agency operation arrested two 19‑year‑olds, a 17‑year‑old, and a 20‑year‑old woman after a ransomware spree hit major retailers. The M&S attack alone shut clothing sales for 46 days, costing around £300 million. Devices have been seized and suspects face charges including money laundering and blackmail.

Why it matters: Major cyberattacks are targeting critical UK retailers, showing how vulnerable essential services remain. The case also ramps up calls for mandatory cyber breach reporting across industries.

Read more: UK police arrest four over cyberattacks on M&S, Co-op and Harrods (Reuters)

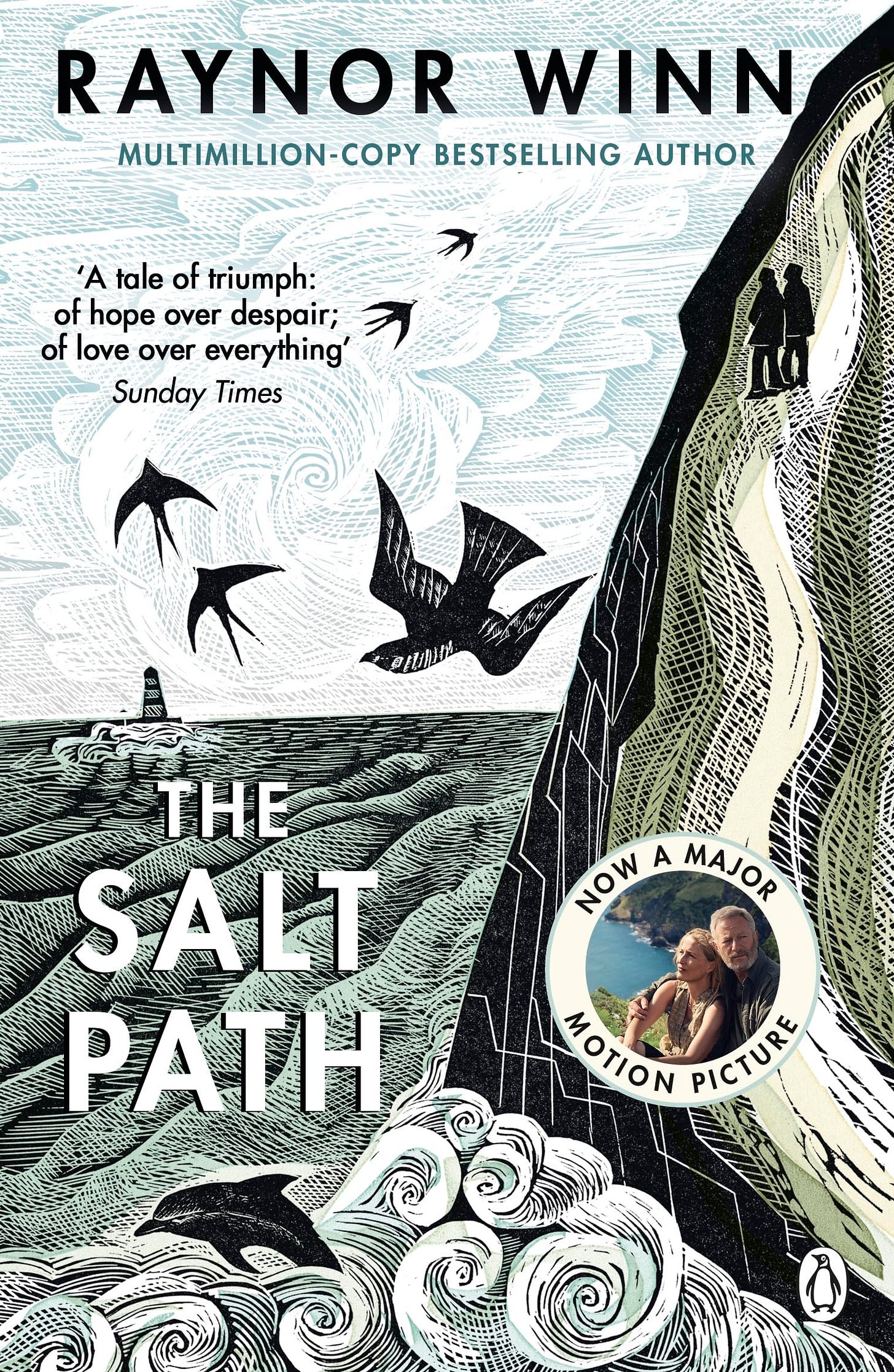

The Salt Path: Unpacking the Financial Scandal

The 99 TL;DR

The UK literary scene is shook. The Salt Path, Raynor Winn’s 2018 memoir about losing their home and walking 630 miles with husband “Moth” (Tim Walker) after a diagnosis, has sold over 2 million copies, generating approximately £9.5 million in revenue. But, a comprehensive Observer investigation was published last week and alleges Winn embezzled around £64,000 from a former employer; misrepresented her husband’s medical condition, and hid ownership of a derelict French property during a claimed period of homelessness.

Let’s look at the allegations, focusing specifically on the financial aspects of the literary controversy.

📘 What is The Salt Path and who is Raynor Winn?

Written by Raynor Winn (born Sally Walker, 1962), a 2018 memoir describes her and husband Tim’s journey along England’s South West Coast Path after losing their farmhouse and Moth’s diagnosis with corticobasal degeneration (CBD). It was widely praised, shortlisted for the Wainwright and Costa prizes and won the 2019 RSL Christopher Bland Prize.

Think earthy wholesome nature writing.

How much money has it made?

Over 2 million copies sold globally, generating an estimated £9.5 million in sales according to Nielsen BookScan (Business Insider).

Initial advance was modest (~£10,000), but sequels and film rights would have significantly boosted earnings (Business Insider).

🔍 Allegations + response

Over the last week, a number of allegations have been made about the truthfulness of The Salt Path. The claims were first reported in The Observer, and Winn has since published a response on her own website. The following draws from both sources.

Embezzlement - the act of secretly taking money or property entrusted to one's care, typically for personal gain

1. Embezzlement & Repayment

Raynor worked as a bookkeeper and allegedly stole approximately £64,000 over several years, discovered by her former boss’s widow through audit traces and cash discrepancies.

She was arrested, questioned, but no charges were filed; instead, she privately settled, repaying via a £100,000 loan from a relative.

The loan had 18% annual interest, was secured against their home, and was structured to avoid criminal charges in exchange for repayment commitments.

Winn’s response:

She admits a dispute with her former employer Martin Hemmings, says she was questioned by police but never charged, and settled the matter privately on a “non-admissions basis”. She expresses deep regret for “any mistakes” made during that time and denies this was the reason they lost their home.

2. Mortgage & Repossession

The couple already carrying a £230,000 mortgage on their farmhouse.

After the relative's business went bust, the loan was sold to third parties who pressed the debt in court.

They lost the case in February 2012 and the house was repossessed by mid-2013.

Winn’s response:

She confirms the loan came from a lifelong friend (pseudonym "Cooper") with 18% interest and a charge on their home. She says Cooper misused the charge to settle his own business debts when his company went bust, and they were unable to afford legal representation, leading to a court loss and repossession.

3. Additional Debts & CCJs

A CCJ, or County Court Judgment, is a court order in England, Wales, and Northern Ireland that is registered against someone for failing to repay a debt. It essentially means a court has formally decided that you owe money to someone. CCJs are registered with the Registry Trust and can negatively impact your credit rating

Following repossession, the new owner received unpaid bills, including credit cards and council fines.

At least five county court judgments (2011–14) are registered, likely due to overdrafts or small debts.

Local debts included around £800 owed to a garage.

They lost the case in February 2012 and the house was repossessed by mid-2013.

Winn’s response:

She denies ongoing debts, states they chose not to go bankrupt, instead repaying what they could using book advances. She says creditors have not contacted them and invites anyone who believes they are owed money to reach out.

4. French Property Contradiction

Despite the homelessness narrative, records show the couple bought a ruined French property in 2007.

The house had no utilities and was uninhabitable, but they owned it through the homelessness period until at least 2013.

Winn’s response:

She confirms owning the land but describes it as a “ruin in a bramble patch”, with no roof, water, or electricity. She says they bought it to prevent a developer from acquiring it, have never lived there, and haven’t visited since 2007.

5. Medical exaggeration

Nine neurologists expressed doubt Moth could live symptom-free for over 12 years with CBD, which typically has a 6–8 year prognosis (Business Insider).

Winn’s response:

She has shared clinic letters confirming his diagnosis of CBS (Corticobasal Syndrome), explains it is often misrepresented and varies widely in progression, and says Moth’s slow progression has responded to walking. She rejects the suggestion that he is faking his condition as “emotionally devastating.”

6. ’Gaslighting’ claims

A Cornish farmer who supported the couple says they misled him about Moth’s health and their involvement in cider-making (The Times).

Winn’s response:

She does not directly name the individual or comment on the cider-making, but suggests many of the Observer's secondary sources are “people who do not know us… and have never seen his medical records.”

What happens next?

Publishing: Her next book, On Winter Hill is delayed indefinitely, with future projects on hold.

Legal action?: Potential lawsuits involving The Observer, Winn, her ex-employer, and former supporters.

Public debate: There is without doubt a renewed scrutiny of memoirs, especially regarding emotional truth versus factual accuracy, discussed here in the FT (Financial Times).

Will she have to pay back any money?

If Raynor Winn is ever proven to have knowingly lied in The Salt Path for money, there’s a chance she'll be asked to pay back some of her profits. Here are two examples that set a precedent:

Other times people made things up…

Misha Defonseca – "Memoir" of Holocaust survival

She wrote about being raised by wolves during WWII. She wasn’t raised by wolves.... A U.S. court made her return $22.5 million in profits to her publisher.

James Frey – A Million Little Pieces

Frey admitted he exaggerated parts of his addiction memoir. He and his publisher set aside $2.35 million to refund readers.

🔗 Sources

The real Salt Path (The Observer)

A woman’s inspiring memoir… now accused… (Business Insider)

Author of bestselling memoir… accused of lying (The Guardian)

Inside the Salt Path controversy…(The Guardian)

Film company defends “The Salt Path” movie… (Entertainment Weekly)

Salt Path couple gaslit me…(The Times)

Salt Path author dropped by charity…(Telegraph)

‘Truthiness’ and why people love a good story (Financial Times)

Statement (Raynor Winn Wesbite)

James Frey's book settlement (The Week)

Author of fake Holocaust memoir ordered…(The Guardian)

The UK economy shrank again.

What this means for you…

The 99 TL;DR

It’s another bad week for Rachel Reeves…UK GDP unexpectedly shrank by 0.1% in May, the second straight monthly drop. A surprise, because economists predicted 0.1% growth. Chancellor Rachel Reeves will address these pressures in this week’s Mansion House speech, where she talks to City leaders. Separately, Bank of England Governor Andrew Bailey hinted interest rate cuts may be on the way as the jobs market weakens. This caused the pound to fall to a three‑week low.

What happened?

The Office for National Statistics reported a 0.1% fall in GDP for May, following April’s 0.3% decline. Analysts had forecast positive growth. Weak consumer spending, industrial production, and construction work were major causes.

Why it matters

One month of economic shrinkage might be forgiven as an anomaly but two points to stalling economic recovery. With public borrowing tight and growth disappointing, Reeves faces a difficult Autumn Budget, potentially involving tax hikes or spending cuts.

What Reeves is likely to say at Mansion House

The Mansion House speech is the Chancellor’s annual address to City of London bigwigs. Hosted at the historic Mansion House (the Lord Mayor's residence), it’s where the Chancellor sets out plans for financial services, regulation, pensions, and key economic priorities for the year.

Thanks to media leaks (likely by the Chancellor’s team), we know that Reeves is likely to…

Emphasise fiscal discipline and commitment to targets through to 2029–30

Announce red‑tape reforms for financial services ie. less regulation

Signal support for green investment via the Transition Finance Pilot

Mention a pensions review and a ‘City concierge service’ to make London an attractive home for businesses

Reassure markets amid the stalling growth backdrop

What Bailey’s comments mean

BoE Governor Bailey signalled that rate cuts are likely if jobs data deteriorates, citing rising “slack” in the economy. This lowered UK base rate odds and pushed the pound down to $1.3467.

What all of this means for you

We don’t know for sure, but we wouldn’t be hugely surprised to see…

Tax rises (on profits, wealth or frozen thresholds) in the Autumn budget

Slower or no personal allowance increases

Potential interest rate cuts in August that could lower mortgage costs

🔗 Sources

Pound drops after Bank of England says it could cut interest rates if jobs market slows (The Guardian)

Rachel Reeves to try to reassure City investors after unexpected UK GDP fall (The Guardian)

Rachel Reeves says May's fall in GDP is 'disappointing'… (City AM)

The 10 Happiest Shift Work Jobs in the UK (and the Most Miserable)

The 99 TLDR: Could working in a vape shop or a florist be the secret to a happy life? Unlikely, but a new report says they fare pretty well in the happiness rankings of shift workers. Doctors, vets, and emergency staff on the other hand are the most stressed. Quelle surprise.

What’s this about?

Deputy’s 2025 Shift Pulse Report asked shift workers across the UK how they felt after every shift. Job happiness has dropped overall, but the differences between sectors are stark.

The 10 happiest shift work jobs

Think predictable routine, low stress (although not sure about restaurant workers tbh), and positive customer interaction:

Tobacco and Vape Stores: 93.42% happy

Sit-down Restaurants: 89.73%

Fast Food: 82.88%

Florists: 82.86%

Food Pop-ups: 82.45%

Cafés and Coffee Shops: 82.00%

Dentists: 81.77%

Childcare and Community Centres: 78.41%

Catering: 75.26%

Cleaning Services: 64.30%

The 10 least happy shift work jobs

Emotional labour, understaffing, and long hours dominate these roles:

Doctors’ Offices and Clinics: 37.84% unhappy

Animal Health: 17.95%

Chiropractors: 12.93%

Critical and Emergency Services: 12.05%

Call Centres: 12.00%

Care Facilities: 6.22%

Primary Education: 6.03%

Community Support Services: 5.35%

Health and Wellness: 4.99%

Trade or Labour Hire: 4.79%

Where are shift workers happiest in the UK?

Warwickshire scored highest with a Net Happiness Score of 88.26%

Manchester: 82.58%

Edinburgh: 75.93%

Greater London: 75.87%

And the lowest?

West Midlands: just 7.15%

Ireland (Northern and Republic): 26.33%

Buckinghamshire: 25.40%

About the data

Over 1.2 million anonymous surveys were submitted between April 2024 and April 2025 via Deputy’s Shift Pulse tool, a feature that prompts workers to log their emotional response at the end of each shift. The report analysed this data to rank job sectors and regions by worker sentiment.

🔗 Sources

Shift Pulse Report (Deputy)

Thank you for reading. If you’ve enjoyed this week’s 99, please consider sharing with a friend or someone who might be interested.

If you aren’t already, make sure you’re subscribed so that you are first to receive the 99 in your inbox every Monday.