💧The Teardrop That Shook Markets 🏚️Where UK Property Flipping Still Pays + ⚰️ The Inheritance Heists You Need to Hear

23rd June 2025

Good afternoon and welcome back to The 99: the home of financial news and insights made simple. You can count on accessible, trustworthy, and unbiased news insights every Monday.

Struggling to view the whole email? Somewhere above this text you’ll see ‘view on web’.

Introducing GFY on Substack

As we mentioned last week, GFY’s emails are now being sent from and hosted on Substack - this won’t change what you receive (other than emails looking a little different) but it should improve your experience of accessing past editions and other content.

Alice & the GFY team x

Career Progression Help

Hello! I’ve been working in marketing for the past 4–5 years. I started in social media and community management, and over time my role has evolved into leading social strategy and overseeing cross-channel communications including website content, email marketing, blogs, PR etc. I’ve been in my current role for just over a year and have been promoted once (though without a pay rise, due to financial challenges in the company). I’ve been told I’m on the list for the next round of pay rises, but if there’s no significant change in the next 12 months, I’ll likely start looking elsewhere. This role has been my first in the education sector, so there’s been a lot of learning involved. Prior to this, my background included a mix of tech, FMCG, and agency-side roles.That said, I’m starting to think about my next move and feeling a bit unsure about what that could look like. The marketing landscape evolves so quickly, sometimes I wonder if my job even existed 10 years ago?! And who knows what roles might exist five years from now? Crazy but also exciting! I’d love to hear from others who started in junior marketing or social roles and worked their way up. My goal for a next step would be a role paying £60k+.

📰 The 99 Quick News

⚽ Liverpool to Cover Diogo Jota’s Salary for Two Years

Following the tragic death of star forward Diogo Jota, Liverpool FC has committed to paying his remaining salary, reported to be around £14.5 million, to his family over the final two years of his contract.

Read more: Liverpool will continue to pay Diogo Jota’s salary to his family (Tribuna)

💼 UK Expands Bereavement Leave to Include Miscarriage

New legislation will grant parents the right to at least one week of bereavement leave for miscarriages before 24 weeks, aligning maternity and paternity leave rights with stillbirths and child loss.

Why it matters:

This marks a significant shift in acknowledging the emotional impact of early pregnancy loss. It ensures both parents can take time to grieve, ending the “forced return to work” after miscarriage.

Read more: Parents to be granted bereavement leave after miscarriage (The Guardian)

📉 Chancellor Eyes Cutting Cash ISA Allowance to £4k

The 99 TL;DR:

We’ve heard it before but it’s back in the news….Chancellor Reeves is reportedly considering reducing the annual Cash ISA limit from £20,000 down to as little as £4,000. The goal? To nudge savers toward investing instead of hoarding cash.

Why it matters:

Critics say it unfairly penalises cautious savers, especially pensioners who prefer low-risk options, while ignoring the real issue: millions of Brits lack access to affordable financial advice. The Financial Conduct Authority is pushing for “targeted support” by 2026, offering personalised guidance rather than cutting allowances.

Read more: A better way to solve the cash ISA problem? Close the advice gap (FT)

How One Tear Shook UK Markets

What happened?

On 2 July, Chancellor Rachel Reeves had perhaps her worst day at work to date. As she sat behind the Prime Minister during PMQs, she was spotted wiping away tears. This came after Labour scrapped planned disability benefit cuts, removing around £5 billion in expected savings from the spring budget. As a single tear fell, immediate speculation about her future and Labour’s fiscal plans became the hot top of conversation.

Reeves’s and Starmer’s responses

Reeves later told reporters it was “a personal matter” and stressed she was “totally” up for the job. There were some rumours of an altercation with the Speaker of the House of Commons but still, nobody really knows why she was crying.

Initially, Starmer dodged questions during PMQs about her position. However, later that day, his office confirmed she was “going nowhere,” and in a BBC interview he said they were “working in lockstep” and that Reeves would remain Chancellor “for a very long time to come”.

Market impact

The market hates instability and the threat of a new chancellor and policy change got investors worried. It went like this:

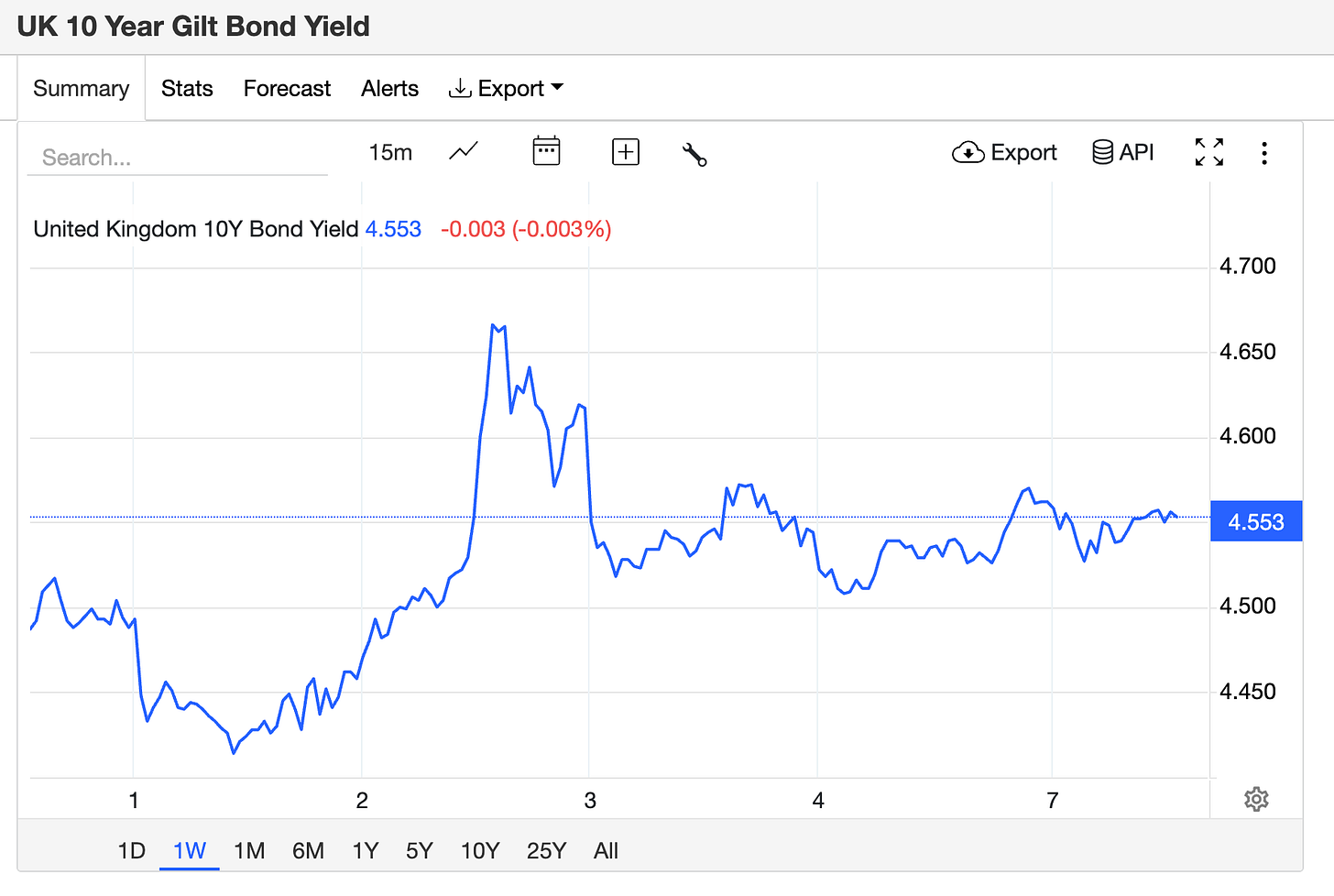

Gilt yields (10-year) surged by around 22 basis points to roughly 4.68 percent, the biggest one-day jump since October 2022.

Gilt yields are the returns investors get from lending money to the UK government by buying government bonds, known as "gilts."

When gilt yields go up, it means the government has to pay more to borrow money, this can also push up things like mortgage rates and borrowing costs across the economy.

The pound fell by about 1 percent against the US dollar.

Investors estimated the market turmoil could add up to £2 billion in additional borrowing costs for the UK.

After Starmer’s strong backing of Reeves, markets calmed somewhat. Gilt yields eased back to around 4.56 to 4.6 percent.

Has the market recovered?

There was a short-term rebound in both gilts and sterling after Starmer publicly backed Reeves, with yields falling from their peak and the pound recovering some losses.

However, the market remains volatile, with investors cautious about the government’s fiscal position and internal stability. Gilt yields remain a bit elevated as you can see here:

Why it happened

A few reasons…The scrapped welfare reform removed a key piece of Reeves’s fiscal plans, leaving a £5 billion gap in the Budget.

Reeves’s emotional moment, coupled with Starmer’s initial hesitation to defend her, rattled markets concerned about Labour’s commitment to fiscal discipline.

The episode brought back memories of the 2022 Liz Truss gilt crisis (remember the Lettuce?), triggering a reaction from investors wary of UK fiscal instability.

Why it matters

Fiscal credibility (ie. how the UK manages its public money) in the UK remains fragile, with markets highly sensitive to political signals and shifts in fiscal policy.

The removal of £5 billion in planned savings has left the government with limited options, either further spending cuts or tax rises.

Labour’s internal tensions and public displays of discord risk undermining both party unity and investor confidence.

Volatile gilt yields and currency movements affect borrowing costs for households, businesses, and the government itself.

Investor sentiment (how investors feel about UK markets) now hinges on whether Labour can maintain fiscal discipline and stability going forward.

What about the £5 billion? Tax rises?

The scrapped welfare cuts were meant to save £5.5 billion, but after a major U-turn, most of the plan was dropped leaving a £5 billion gap in the budget. It needs to be filled somehow…

Rachel Reeves has hinted tax rises could now be on the table this autumn, saying it would be "irresponsible" to rule them out after watering down the policy.

This gap risks breaching the strict fiscal rules Reeves set last year, meaning more difficult choices ahead.

Flipping Hell: Where UK Property Flipping is Still Happening (and Where It’s Not)

The Flipping Index: Q1 2025

The 99 TL;DR:

Property flipping has fallen to its lowest level in more than a decade. Shrinking profits and rising costs are pushing investors further north, with flipping now concentrated in the North East, Midlands and Wales.

What is property flipping?

It is when someone buys a home and re-sells it within 12 months, aiming for a quick profit.

How common is flipping right now?

Only 2.3 percent of homes sold in early 2025 had been flipped. That is the lowest level since 2013.

What kind of profits can you expect?

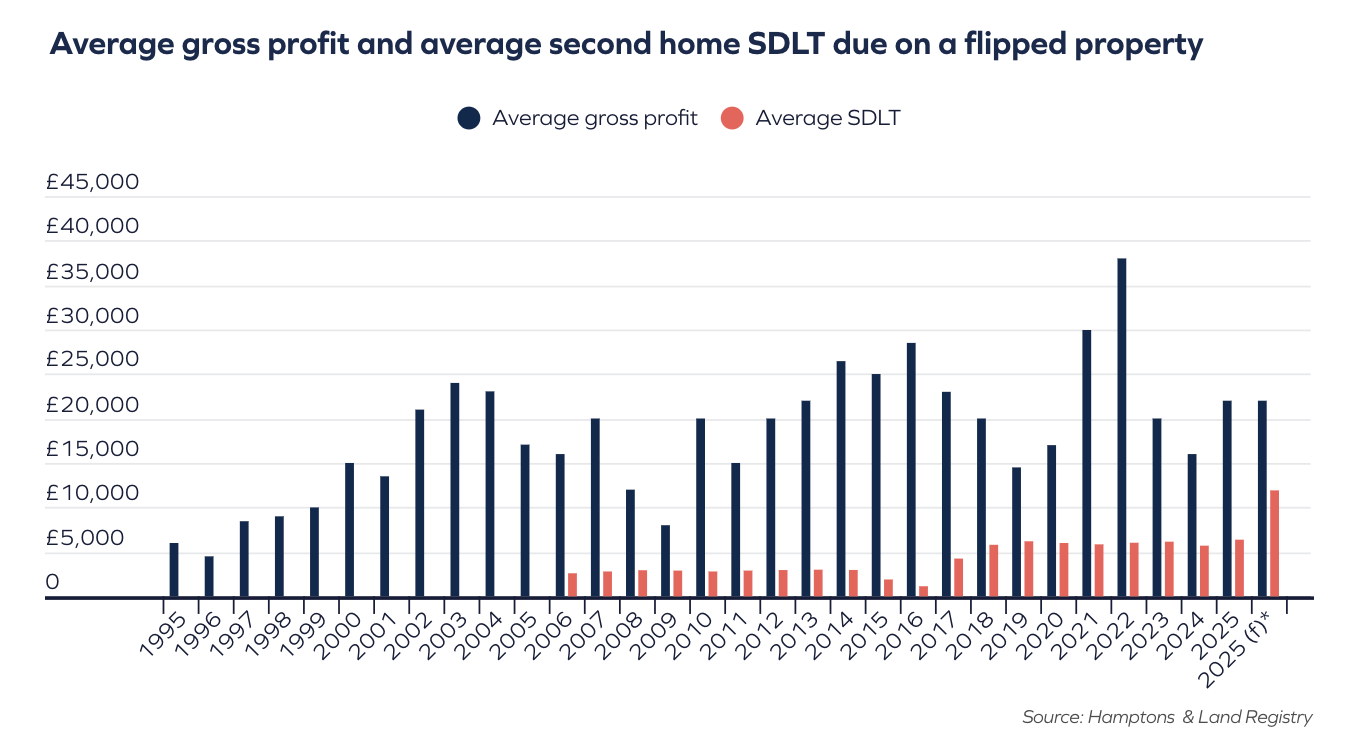

The average gross profit on a flipped property in England and Wales in early 2025 was £22,000. This is slightly higher than last year but far below the £38,000 peak in 2022.

In percentage terms, gross profits have fallen from 17 percent in 2015 to just 10 percent in 2025.

Gross vs net profit

Gross profit is the difference between the buying and selling price of a property. Net profit is what is left after costs like stamp duty are deducted.

After stamp duty is paid, the average net profit from flipping is now just £12,000, giving a return of only 7 percent on the purchase price. That’s less than half the return investors made in 2015.

Why are profits shrinking?

📉 Slower house price growth is the main reason, but stamp duty costs are a big factor too.

🏡 Stamp duty rules have changed over the past decade. In 2015, investors paid the same stamp duty as homeowners. Now, extra charges for second homes mean the average investor paid around £11,900 in stamp duty in early 2025, eating up nearly a third of gross profits.

Around 80 percent of flipped homes still sell for more than they were bought for, but only 66 percent actually make a net profit after stamp duty is paid.

🧱 Labour and material costs Even before accounting for stamp duty, many investors face higher costs for labour and materials.

How much can you make in different regions?

The North East remains the biggest flipping region, with strong activity in Redcar and Cleveland, Hartlepool and Sunderland. More than sixty percent of flipped homes are now in the Midlands, North and Wales.

Here’s the flipping rate and average gross profit by region:

North East: 4.7 percent flipped, £14,250 average profit

Wales: 3.1 percent flipped, £25,000 average profit

Yorkshire and the Humber: 3.0 percent flipped, £18,995 average profit

East Midlands: 2.8 percent flipped, £13,500 average profit

North West: 2.8 percent flipped, £25,000 average profit

West Midlands: 2.5 percent flipped, £25,000 average profit

South West: 2.2 percent flipped, £20,000 average profit

East of England: 1.8 percent flipped, £22,000 average profit

South East: 1.8 percent flipped, £23,000 average profit

London: 1.5 percent flipped, £59,000 average profit

Where are the hotspots?

These are the areas with the highest share of flipped homes in early 2025:

Redcar and Cleveland, North East, 7.6 percent

County Durham, North East, 6.6 percent

Hartlepool, North East, 6.5 percent

Burnley, North West, 5.8 percent

Bassetlaw, East Midlands, 5.2 percent

Newport, Wales, 5.0 percent

Rhondda Cynon Taf, Wales, 4.9 percent

Merthyr Tydfil, Wales, 4.9 percent

North Tyneside, North East, 4.8 percent

Sunderland, North East, 4.8 percent

Great Yarmouth, East of England, 4.8 percent

Neath Port Talbot, Wales, 4.8 percent

Blaenau Gwent, Wales, 4.7 percent

Torridge, South West, 4.6 percent

Pendle, North West, 4.5 percent

Erewash, East Midlands, 4.4 percent

North East Derbyshire, East Midlands, 4.4 percent

West Lindsey, East Midlands, 4.3 percent

Caerphilly, Wales, 4.3 percent

Wigan, North West, 4.2 percent

Why does this matter?

Flipping usually thrives when house prices are booming. The drop in flipping shows how much harder it has become to make money from quick property sales, and highlights how heavily investors now rely on cheaper areas where costs like stamp duty are lower.

The House Heist You’ve Never Heard Of: Gangs Are Stealing Inheritances

The 99 TL;DR:

A new BBC podcast reveals how organised gangs are stealing homes from people who die without a valid will. In Shadow World: The Grave Robbers, reporter Sue Mitchell uncovers scams that could affect thousands of families.

Wait, people can really steal houses?

Yes. Criminals are forging fake wills to claim estates from people who die without one in place.

How does the scam work?

When someone dies without a will, their estate usually goes to their closest relatives. But scammers create fake wills naming themselves as “dear friends” and sole heirs, giving them legal control over the entire estate.

Is it really that simple?

Shockingly, yes. In one case, scammers produced a will that used an address which didn’t even exist when the will was supposedly signed. Even with clear red flags, the police and probate services said there would be no investigation.

Why should you care?

Many people do not have an up-to-date will. This story shows how vulnerable those estates can be. Victims are often told their only option is a civil court case, which can cost tens of thousands of pounds. A good reminder to you and your family members to write or update your will.

For more, have a listen to this brilliant investigative podcast unearthing inheritance scams

🎧 Shadow World: The Grave Robbers on BBC Sounds

See you next week!

📚 Sources

Tears of the UK's treasury chief spooked financial markets

AP NewsMarch 2025 United Kingdom Spring Statement

WikipediaUK's Reeves says she is getting on with her 'tough' job

ReutersUK PM gives full backing to Reeves after tearful appearance in parliament

ReutersUK bond rout draws Truss comparisons as public finances rattle investors

ReutersUK bond yields rise sharply amid speculation over future of Rachel Reeves

The GuardianTears and turmoil: The bond market rescued Rachel Reeves from Keir Starmer

Barron’sHas Keir Starmer placated gilt investors?

FT

Where UK Property Flipping is Still Happening (and Where It’s Not)

Hampton’s Q1 2025 Flipping Index

The House Heist You’ve Never Heard Of: Gangs Are Stealing Inheritances

Shadow World: The Grave Robbers